|

FINANCING

OPTIONS...QUALIFYING FOR A HOME LOAN

Financing options can be

overwhelming to all of us. There's simply no way to know about all the

available options, much less decide which one is best for you long-term.

You can choose any lender, but if you want to ensure a worry-free closing,

I have access to a team of first-class mortgage experts who always ensure

that my customers not only understand what mortgage options are available,

but more importantly, receive the best possible rates and terms.

Mortgage Options

Mortgage Options

Key Components to Most

Adjustable Rate Mortgages (ARM)

Key Components to Most

Adjustable Rate Mortgages (ARM)

Understanding Interest-only Mortgages

Understanding Interest-only Mortgages

What Your Monthly

Mortgage Payment Consists of

What Your Monthly

Mortgage Payment Consists of

Questions to Ask Lenders

Questions to Ask Lenders

How much can

I afford?

How much can

I afford?

What are

the current "average" mortgage rates this week?

What are

the current "average" mortgage rates this week?

What are

VA Loans and Do I Qualify?

What are

VA Loans and Do I Qualify?

Buyer 24-Month Investment

Protection Program

Buyer 24-Month Investment

Protection Program

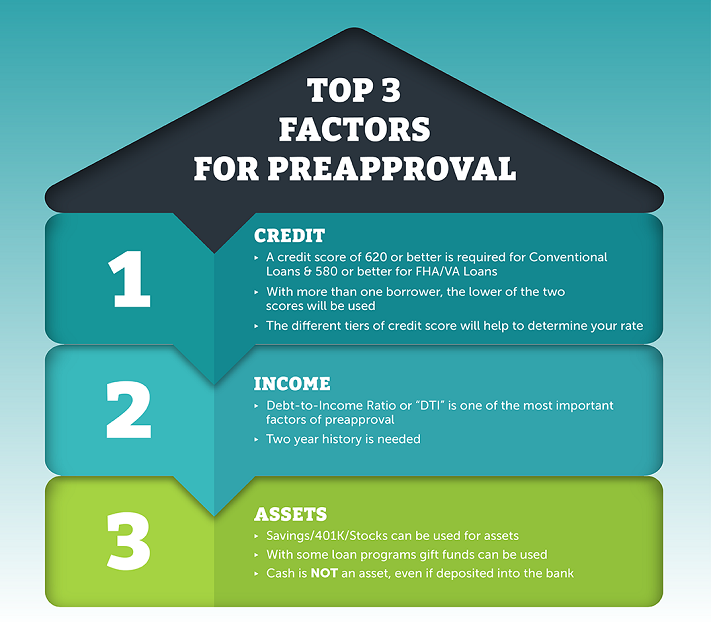

Get Pre-Approved for a

Home Loan

Today!

Get pre-approved for a home

mortgage loan today!

Reach out to one of my preferred mortgage loan brokers below who can help you get

pre-approved for a loan.

There is absolutely no charge or obligation and is a vital

first step in preparing to purchase a property.

|

Mortgage Options & Loan Types |

-

30-year conventional fixed rate loan - benefits include:

-

Monthly payments for principle and interest remain the same over

the life of the loan

-

Lower monthly payments when amortized over a 30-year payment

period.

-

30-year VA Loan (exclusively for military veterans) - VA benefits include:

-

Monthly payments for principle and interest remain the same over

the life of the loan

-

Outstanding interest rates

-

$0 Money Payment Required

-

$0 Monthly Mortgage Insurance Premiums - saves

hundreds of dollars each month!

-

Click here to learn more

about VA Loans

|

-

10, 15 or 20-year conventional fixed rate loans - Benefits

include:

-

Monthly payments of principle and interest remain the same over

the life of the loan

-

Substantial savings of interest over the life of the loan

-

Payments are approximately 25-30% higher when amortized over a

shorter period of time.

|

-

No-Point/Zero Closing Cost loan - Benefits include:

-

Less cash needed at closing. The interest rate will usually be ?

to ? of a percent higher when compared to loans that have points

to pay at closing.

|

-

7-year fixed rate balloon w/ 30-year amortization - Benefits

include:

-

Slightly lower rate and/or less fees than the conventional 30-year

fixed rate loan.

-

Payment of principle and interest remains the same over the 7-year

period of time (at the end of 7 years, you will need to pay off

the remaining balance with either a lump sum of cash or re-finance

the remaining loan amount).

|

-

Adjustable Rate Mortgages (ARM) - There are many options with ARMs;

the most popular tends to be the 1-year ARM with a 30-year

amortization schedule. Benefits include:

-

Lower interest rate for the 1st year

-

Easier to qualify for the loan amount

-

You can qualify for a larger loan amount

-

A year ARM offers the ability to adjust downward at the 1 year

anniversary of your loan.

-

I have

never been a big fan of ARM's because interest rates have been at or

near historical levels for the past five years, so an ARM just

didn't make sense. Anyone applying for this loan type needs to

be certain that they understand what the future interest rate

adjustments are or you can get into big trouble.

|

-

80/10/10 Conventional Loans

-

a loan program that

consists of an 80% first mortgage + a 10% second mortgage + a 10%

down payment. In this case, since there is no mortgage insurance

required, the buyer will save the monthly premium.

-

This

loan type (or variations of it) was extremely popular during the

past 3-5 years. The primary purpose of this loan is to avoid paying

PMI (private mortgage insurance) for buyers who were unable to put

down 20%.

-

It is

always best to consult with a

mortgage broker on the best type of loan program that best meets

your needs and does not over-extend your financial situation.

|

-

Mortgage Loan Recasting:

A mortgage recast (also called a loan recast) s

a feature in some types of mortgages where the remaining payments

are recalculated based on a new amortization schedule. During a

mortgage recasting, the borrower pays a large sum toward their

principal, and their mortgage is then recalculated based on the new

balance. It's a simple and low-cost procedure that lowers your

monthly loan payments without the need to refinance. Ask your lender

if they offer this program.

|

|

|

|

|

|

Key Components to Most Adjustable Rate

Mortgages (ARM): |

-

Index Rate - the rate to

which the interest rate on an adjustable rate loan is tied. One of

the more popular indexes used is the 1-year U.S. Treasury bill.

|

-

Margin - the amount

added to the index rate that represents the lender's cost of doing

business.

|

-

Interest Rate Cap Per

Adjustment - the maximum amount a borrower's interest rate may

increase or decrease at the time of adjustment..

|

-

Life Cap - this is the

ceiling that the note rate cannot exceed over the life of the loan.

|

-

Amortization - a period

of time in which gradual repayment of debt occurs by means of

systematic payments of principle and/or interest. At the end of the

time period the balance is zero.

|

|

|

What Your Monthly Mortgage Payment

Consists of: |

-

Principle balance: this represents the money you originally borrowed

and are paying back over the life of the loan.

|

|

|

-

Real estate taxes: normally 1/12 of the most recent tax bill.

|

-

Insurance (Home Owners): normally 1/12 of the yearly policy amount.

|

-

Private Mortgage Insurance (PMI) - Some borrowers who have less than

20% down are required to pay PMI.

|

-

Assessments (if any, condo, townhome, single family home) -

depending on the type of dwelling, you may or may not be required to

pay assessments.

|

|

|

Questions to Ask Lenders |

-

Based on your situation, what looks like the best program for me &

why?

|

-

What is the projected time for processing and closing a loan?

|

|

|

-

If PMI (Private Mortgage Insurance) is required, when and how does

it go away?

|

-

What about your rates, terms, fees, etc - are they negotiable?

|

-

Are there any special underwriting guidelines you follow?

|

-

What if rates go down during the ?lock-in? period?

|

-

What do you need to get a loan approved?

|

|

|

Home Buyer's Guide

Home Buyer's Guide

Get pre-approved for a home

mortgage loan today!

Reach out to

one of my preferred mortgage loan brokers below who can help you get

pre-approved for a loan.

There is absolutely no charge or obligation and is a vital

first step in preparing to purchase a property.

|

|

FIND YOUR DREAM HOME

NOW! |

SEARCH HOMES NOW!

HomesForSaleDenverColorado.com

MLS Listings Powered by remax.com |

SEARCH HOMES

NOW!

SearchHomesInDenver.com

Search ePowered by remax.com |

SEARCH HOMES

NOW!

HomesInColorado.info

ePowered by REMAX |

JUST LISTED

Just Listed : $200,000 - $2M

Just Listed : $200,000 - $2M

Just Listed : $100,000 - $500,000

Just Listed : $100,000 - $500,000

Just Listed : $500,00 to $1M

Just Listed : $500,00 to $1M

Just Listed : $1M to $1.5M

Just Listed : $1M to $1.5M

Just Listed : $1.5 - $2M

Just Listed : $1.5 - $2M

Just Listed : $2M - $2.5M

Just Listed : $2M - $2.5M

Just Listed : $2.5M - $3M

Just Listed : $2.5M - $3M

Just Listed : $3M - $5M

Just Listed : $3M - $5M

Just Listed : $5M - $10M

Just Listed : $5M - $10M |

SEARCH HOMES IN DENVER

Search Homes : $300,000 - $3M

Search Homes : $300,000 - $3M

Search Homes : $100,000 - $500,000

Search Homes : $100,000 - $500,000

Search Homes : $500,000 to $1M

Search Homes : $500,000 to $1M

Search Homes : $1M to $1.5M

Search Homes : $1M to $1.5M

Search Homes : $1.5 - $2M

Search Homes : $1.5 - $2M

Search Homes : $2M - $2.5M

Search Homes : $2M - $2.5M

Search Homes : $2.5M - $3M

Search Homes : $2.5M - $3M

Search Homes : $3M - $5M

Search Homes : $3M - $5M

Search Homes : $5M - $10M

Search Homes : $5M - $10M |

SEARCH CONDOS IN DENVER

Search Condos : $200,000 - $2M

Search Condos : $200,000 - $2M

Search Condos : $200,000 - $500,000

Search Condos : $200,000 - $500,000

Search Condos : $500,00 to $1M

Search Condos : $500,00 to $1M

Search Condos : $1M to $1.5M

Search Condos : $1M to $1.5M

Search Condos : $1.5 - $2M

Search Condos : $1.5 - $2M

Search Condos : $2M - $10M

Search Condos : $2M - $10M |

|

New Homes In

Colorado | New Home Builders | Buying a New Home | 55+

Communities

First-Time Buyers | Luxury Homes | Energy-Efficient Homes

| New Construction

SearchNewHomesInColorado.com

Arvada, CO | Aurora,

CO | Boulder,

CO | Brighton,

CO | Broomfield,

CO | Castle

Rock, CO | Denver,

CO | Erie,

CO | Golden,

CO | Highlands

Ranch, CO

Lakewood, CO | Littleton,

CO | Parker,

CO | Thornton,

CO | Westminster,

CO | Wheat

Ridge, CO

/

RESIDENTIAL REAL ESTATE /

NEW HOME CONSTRUCTION /

RELOCATION /

FIRST-TIME BUYERS /

INVESTMENT PROPERTIES /

|

Buyer Guide |

Sellers

Guide |

New Home

Construction |

Buy a Home

Search for Homes |

Local Mortgage Lenders |

Mortgage Loans

metroDPA Down Payment Assistance

Program |

First-Time Buyers

Military/VA Home Loans |

Relocating to Colorado |

Active & Sold Listings

Sell a Home |

Property Values |

Denver Market Report

|

Refer a Client

realtor.com Reviews |

Meet Anthony

|

'JustCallAnts'

|

Connect with Anthony

© 2005-2026 ▪

ANTHONYRAEL.COM

| ALL RIGHTS

RESERVED | PRIVACY |

SITEMAP | HOME |

REFERRALS

Anthony Rael |

REMAX

Alliance - Denver |

3900 E. Mexico Ave, #970, Denver, CO 80210 | 303.520.3179

Each Office Independently Owned and Operated

|